Our Spring market is winding down, and the market is turning towards buyers favor

If the market is changing, why would a buyer buy?

• Predicting the future market is impossible….ask Wall Street

• Market timing is difficult to impossible. A buyer should buy when the time is right for them

• As with any market, Buyers should:

1. Like the location

2. Plan on living there for at least 6 years

3. Be able to afford the payment

• If the above three conditions are true, history supports time will take care of any market adjustments

• It is a home first and a financial investment 2nd

• You may actually be ready to become a Buyer instead of just making offers

• Buyers can be more selective, especially now, with the historically best three listing months to be May, June and July

• Buyers may be able to include inspection, financing, and appraisal contingencies. Possibly even negotiate credits/concessions!

What does a changing market mean for Sellers?

• Sellers may only get list price or less. You need to be ready to list at a number that is satisfactory to you, if you only get one offer at list price, will that be enough to get you to your next chapter?

▪ Multiple offers are slowing down. But there will still be strength in the terms of the offer that does come to you

• Consider carefully pricing near value and expect fewer offers

• Cautiously reconsider setting an Offer Review date, or maybe not setting one at all

• A Seller procured inspections is still relevant and can net you an offer with fewer contingencies

• Buyers may still see the list price as a starting place. Listing brokers may need to call

In Summary

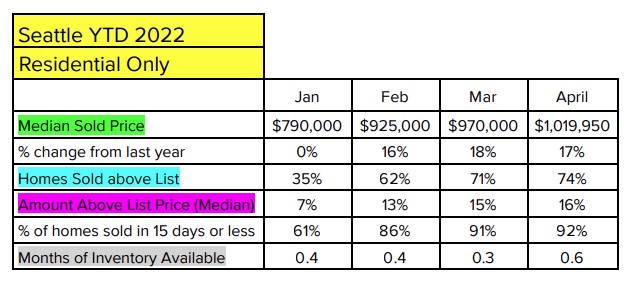

April Median Sold price for residential homes in Seattle reached $1,019,950

74% of homes listed in April sold _over_ list price

Median amount of overbid in April was +16% over List price, that buyers paid +16% over list price in bidding escalations

But the market may be reaching a peak

Predicting the market is difficult. The last correction was in 2018. In three years from June 2015 to June 2018 prices had risen $237,500 or+ 41% from $575,000 to $812,500.

During the same time, interest rates had increased from 3.98% to 4.57%.

Prices dropped 10% from $830,000 (May 2018) to $750,000 (Oct 2018) and took 22 months (October 2018 to Aug 2020) to recover and get back to $825,000

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link